who pays sales tax when selling a car privately in illinois

The total amount of tax collected depends on the cars model year and the. WHEN SELLING YOUR CAR Reporting a wrong purchase price is FRAUD.

What Is The Sales Tax On A Car In Illinois Naperville

Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000.

. Youll need to have the title sales tax form and other paperwork which varies according to the situation. Form 1181E Download Fillable PDF or Fill Online. It starts at 390 for a one-year old vehicle.

In addition to state and county tax the City of Chicago has a 125 sales tax. There is also between a 025 and 075 when it comes to county tax. Instead the buyer is responsible for paying any sale taxes.

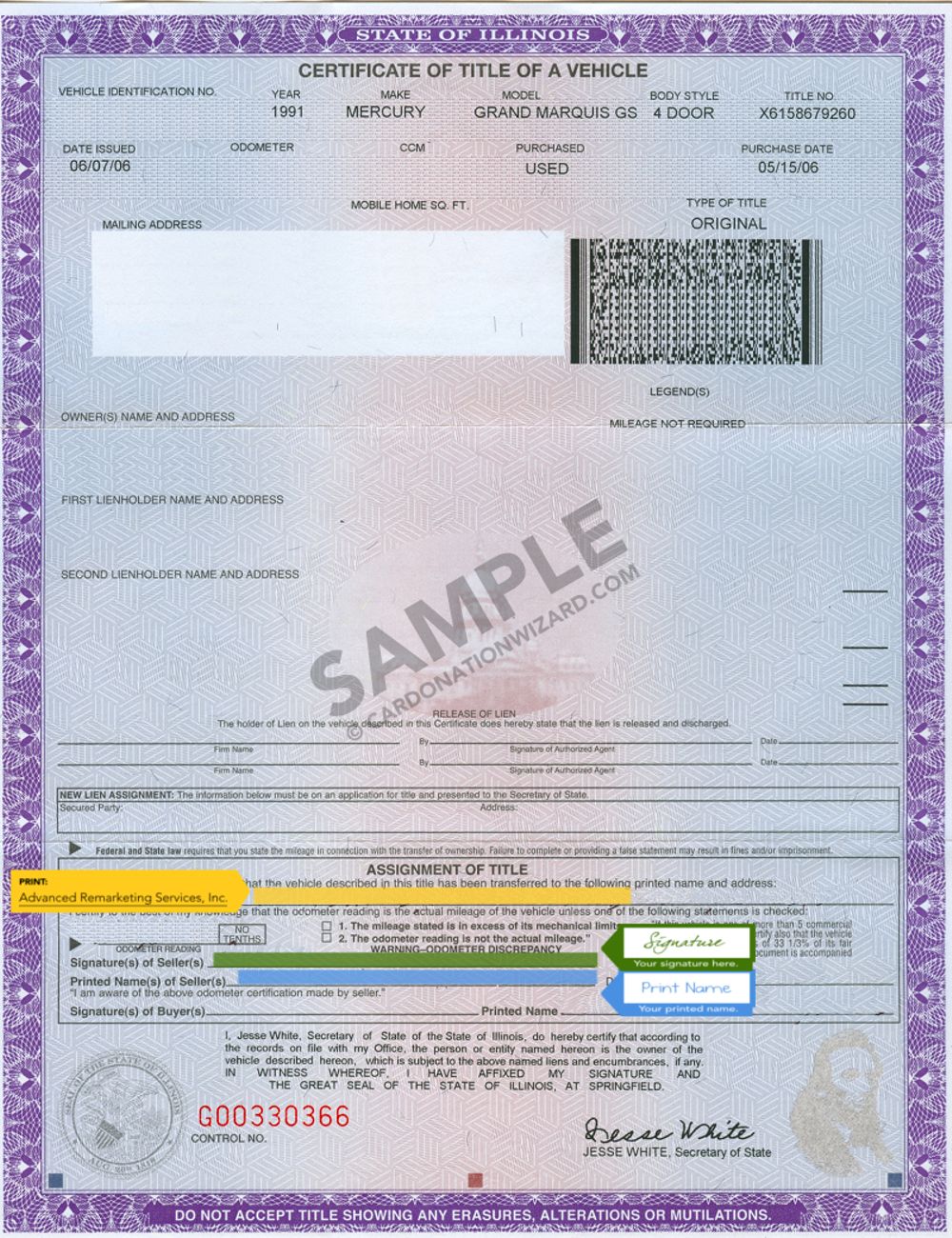

Take alluring pictures of your car. You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit.

Form ST-556 Sales Tax Transaction. When you sell your car you must declare the actual selling purchase price. If youre buying a car for 40000 and your trade in is worth 20000 you only have to pay tax on the difference which in this case is 20000.

There is also between a 025 and 075 when it comes to county tax. Who Pays Sales Tax When Selling A Car Privately In Florida. It ends with 25 for vehicles at least 11 years old.

For a vehicle transfer that occurs from January 1 2021 through. If possible you should consider a private sale as this can be a more lucrative option. Once the buyer has the vehicle registered under his name he must pay to sell Texas.

Heres how the law works. The amount that you have to pay for your. This rate doesnt include any additional county taxes or title transfer fees.

Youre supposed to pay it when the vehicle gets. In addition to completing the application form you. Once the lienholder reports to flhsmv that the lien has been satisfied.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Since the missouri tax appears to be 4225 and the standard illinois tax on vehicle sales is 625 you must pay the 2025 difference. To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person.

I bought a hybrid car recently. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. If you have problems with a title or registration on Selling a vehicle in illinois.

To get started selling a car in Illinois take these steps to get it ready. Saying a SALE is a GIFT is FRAUD. Take out all personal belongings.

Who Pays Sales Tax When Selling A Car Privately In Florida Do i have to pay tax when i buy my car. You can often get much more than a trader would give you. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

Illinois sales tax on car purchases. With any private car sale in the state buyers must submit Tax Form RUT-50 and pay the 625 state sales tax to the county tax collector. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation.

Although the buyer pays for this inspection the seller and buyer must agree on when and where the inspection is to be held. See our Title Transfers in Illinois page for complete details. Remove all trash from the vehicle.

Unless of course you reside in those Metro-East communities with a 65 tax on vehicle sales. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

Buff out any scratches. You can process the transaction at your local Secretary of State office or by mailing the paperwork to the Secretary of States main office. Then the difference is 2275.

Take time to carefully read your sales contract and question any additional fees you don t understand or don t feel are necessary. Thats 2025 per 1000. When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when.

Taking these steps will help you get the car ready to sell and for prospective buyers to look at. Fill out a Private Party Vehicle Tax Transaction form. Get a car wash.

For vehicles that are being rented or leased see see taxation of leases and rentals. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference. Cost of buying a car in illinois increased in 2020 Buyers must pay a transfer tax when they buy a car from a private seller in illinois although this tax is lower when you buy from a private party than when you buy from a dealer.

Cost of Buying a. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Safety Administrations NHTSA odometer disclosure requirements were updated in December 2020 impacting certain private vehicle sales in Illinois.

This important information is crucial when youre selling. How Much Sales Tax On A Car In Illinois Car Sale and Rentals. If you buy a 1-year used model from a dealership for 14000 and the tax rate is 7 youll end up paying 980 in sales tax which is nearly 600 more than if you bought one through a private party.

To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle.

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Safe Ways To Pay Or To Accept Payment For A Used Car Auto City

Sales Tax How Sales Tax Is Calculated Pipedrive

How To Transfer A Car Title Nerdwallet

Can I Just Sign A Car Title Over To Someone Sell My Car In Chicago

Find Out If You Have To Pay Import Tax When Shipping A Car To The Usa And How Much It Costs As Well As Information On Exemptions Gas Guzzler Tax And More

Forms For Selling A Car In Illinois At Cars

Registering A Car In Florida How To Register An Out Of State Car

Car Sales Tax In Maine Getjerry Com

North Carolina Sales Tax Small Business Guide Truic

What Is Illinois Car Sales Tax

Forms For Selling A Car In Illinois At Cars

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Can I Just Sign A Car Title Over To Someone Sell My Car In Chicago

Liability And Risks Of Selling Your Car Driveo

Car Financing Are Taxes And Fees Included Autotrader